About Us

What We Are

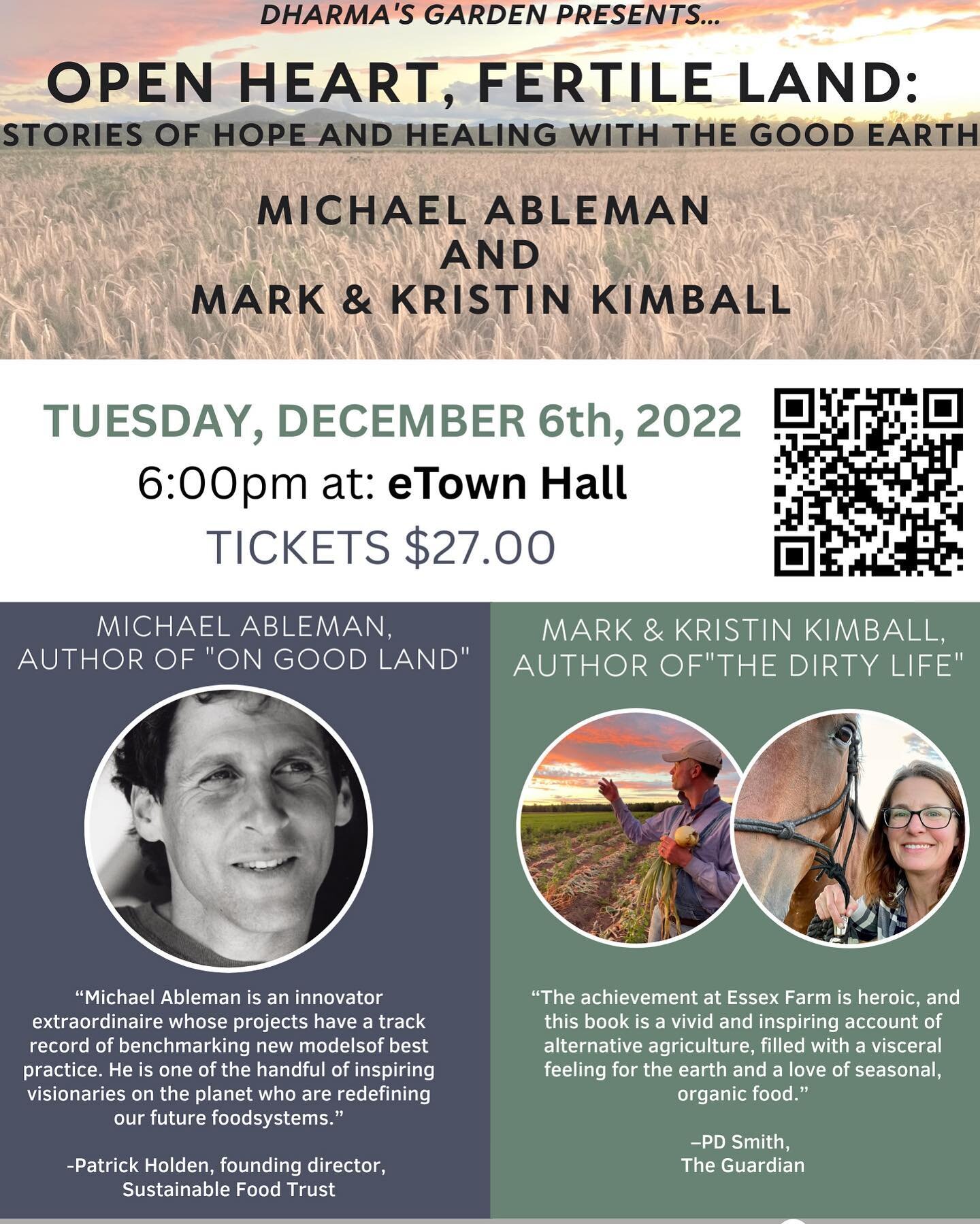

Founded in 2014 as a 501(c)(3) nonprofit educational project, Dharma's Garden has since grown into a thriving center of connection within the local community. Here, people are connected to each other—through meaningful work, seasonal festivals, and social activities. Just as importantly, people are connected to the natural world—through educational programs, hands-on activities, and immersive experiences.

Through our productive half-acre garden, lively onsite markets, popular seasonal festivals, and diverse educational programs for adults and children of all ages, Dharma's Garden is a project of the community, by the community, and for the community.

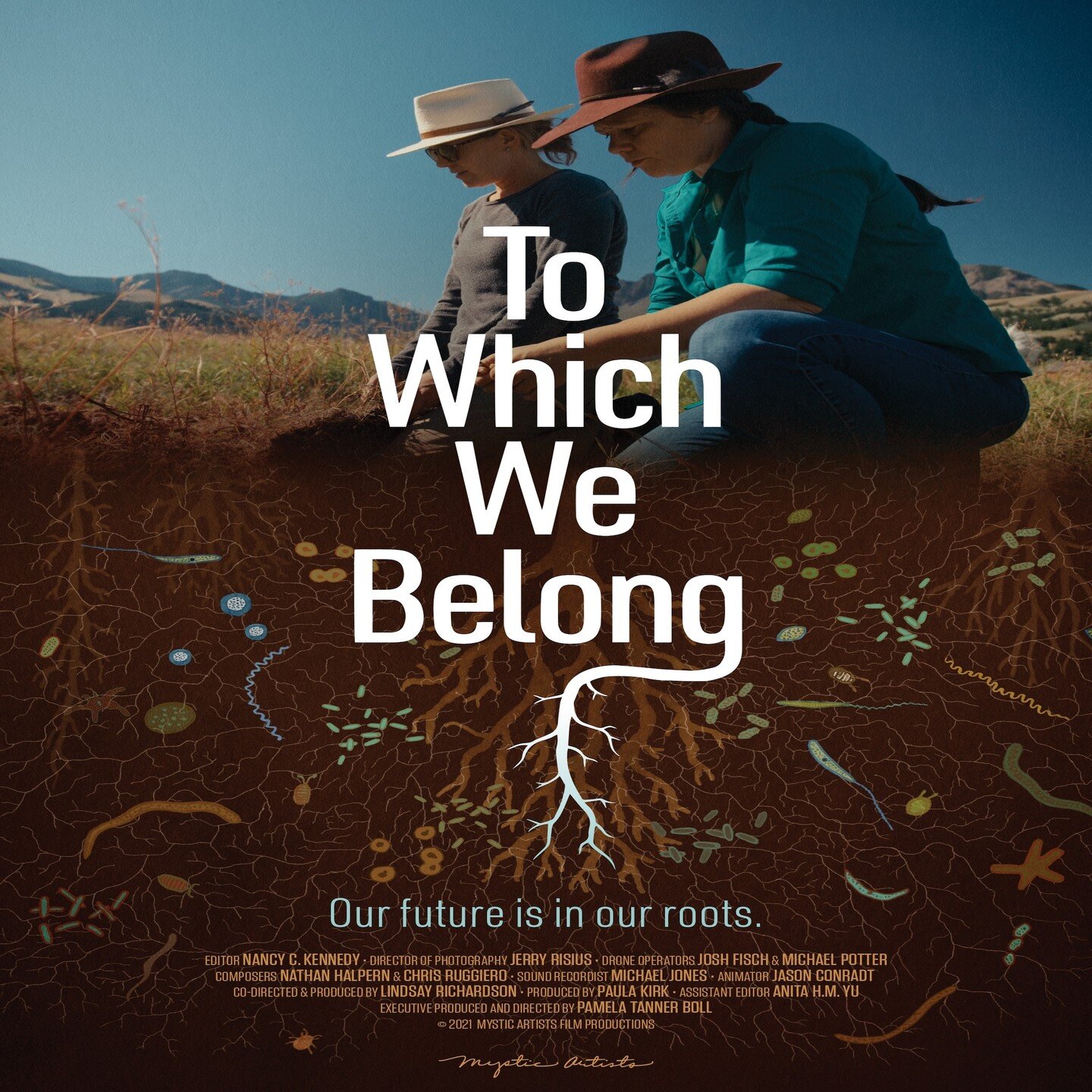

Dharma's Garden brings a direct connection to sustainable agriculture right into the heart of the city, fully integrated with the community, accessible and inclusive, offering freely to visitors an immersive experience that is all but lost in the modern world today. Using organic, biodynamic, and regenerative agricultural practices, this living homestead serves as a model for ethical land stewardship, with wild areas and cultivated areas both integral to the whole.

Our Mission

To demonstrate, educate, and inspire others to take on the noble work of tending the earth.

What We Offer

We grow many different kinds of fresh vegetables, herbs, and flowers — and duck eggs, too! We share with the surrounding community through our onsite markets, June to October. We occasionally have additional produce available at our self-serve Little Garden Stand.

We sometimes offer seeds and live plant starts in the spring, and various other products throughout the year including herbal products (salves, bath salts, etc), and a limited selection of canned or prepared foods (as allowed by Colorado's Cottage Foods law).

We offer many classes & workshops for both adults and children, apprenticeship opportunities, and seasonal events.

Mainly, though, our focus is on sharing the experience of tending the land, connecting with nature, and connecting to each other, through small-scale sustainable agriculture.

Our Story

Dharma's Garden is situated on a 5-acre parcel of land traversed by Wonderland Creek in northwest Boulder, Colorado. Sheep grazed this land in the mid 1900s, and it has been largely untouched since then. In 2014, Boulder native Tim Francis and his wife, Kerry, settled onto the land and cultivated a half-acre garden with the intention of sharing some of its magic with the surrounding community, as well as the wider world. The garden we call Dharma’s Garden—named after a deer who was born where the garden now stands (more on him below).

In 2021, over 600 families came together to contribute towards saving Dharma’s Garden, allowing our nonprofit to purchase this property with the intention of protecting it in perpetuity. Learn more about our land acquisition story below.

This dream continues to unfold with the generous support of our community.

Meet the Team

-

Our Board

-

Capstone Team

What People Say about Dharma’s Garden

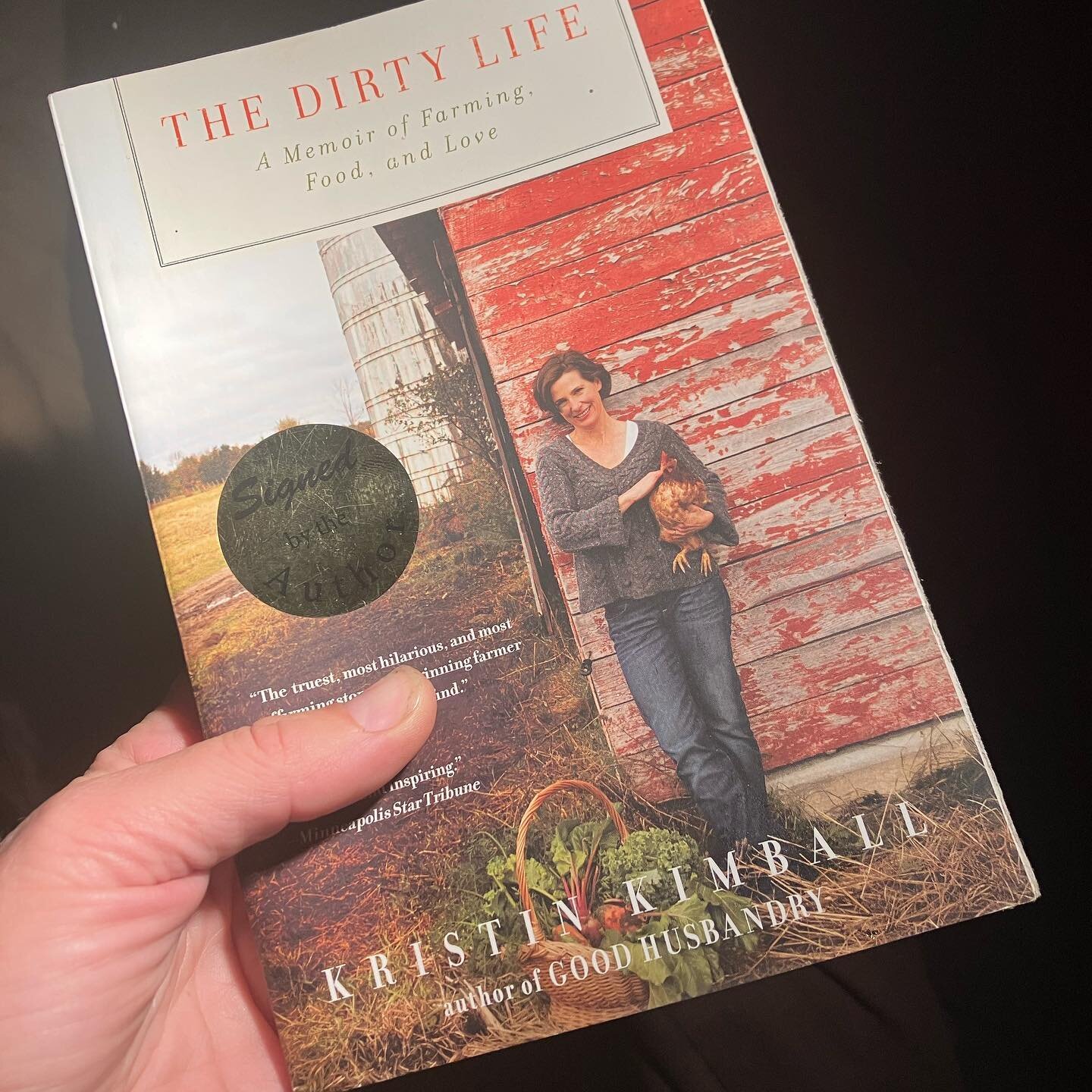

Saving Dharma’s Garden

When we moved to this beautiful land in 2014, we knew that as renters, our tenure on the property was not totally secure. Still, we were inspired to put in a garden, and to share the abundance with the surrounding community. Over the years, we added educational programs and festivals, onsite markets and special events, and we noticed that this land was not just meaningful to us — it had become beloved to our community as well.

When the owners decide to sell in 2019, we knew had to do our best to try to save this land from being developed. We hoped our community would be inspired to help.

After two years of near-constant work, behind-the-scenes strategizing, community pledge-raising events, chats with conservation experts, attorneys, engineers, ecologists, and farmers, we succeeded in raising the funds so that our nonprofit could purchase this property.

On the autumnal equinox in September of 2021, our nonprofit officially acquired this magnificent 5-acre property that we had been stewarding for over 7 years.

So Dharma’s Garden continues, thanks to the incredible outpouring of support of over 600 families who collectively contributed more than $4.5 million to make this miracle happen.

Read more about our land acquisition story in this article by Sarah C. Beasley, “Cultivating Wild: The Miracle of Dharma’s Garden!”

Learn More About Dharma’s Garden

-

Find our location, how to arrange a visit and volunteer, how to donate to our project, how to get our veggies, and see our upcoming events.

-

Learn more about our farming practices here at Dharma’s Garden, including more about biodynamic agriculture.

-

Find out about our children’s programs, which include different opportunities for toddlers all the way up to teens here on the farm.